Horticulture industry trends for 2026

By Traci Dooley

National Agency Sales Director for Hortica®, a brand of the Sentry Insurance Group

As we move into 2026, it’s a smart time to take stock of where your horticultural business stands. Every year brings new opportunities—and new risks—for florists, garden centers, nurseries, greenhouse operators, and landscapers. From shifting weather patterns and sustainability pressures to digital adoption and automation, the decisions you make today will shape tomorrow’s success.

As you plan for the year ahead, make time to review your risk management strategies and insurance coverage. I’ve identified six key trends shaping our industry, and practical steps you can take to help you stay protected and productive.

Top 6 trends to watch in 2026

1. Commercial auto remains the biggest cost-driver

Commercial auto insurance continues to be one of the largest—and most volatile—expenses for horticultural businesses. Whether you’re delivering flowers, transporting plants, or hauling materials, the costs tied to vehicle accidents and claims remain a major concern.

Repair and replacement costs are still elevated, accident severity continues to rise due in large part to distracted driving, and injury costs are higher. The legal environment has also changed dramatically. Attorney involvement in claims has increased dramatically, and jury awards have risen—driving up premiums across the industry.

However, this is one of the few cost areas you can directly influence. Fewer auto accidents means fewer claims and less ancillary costs. Steps you can take to help prevent accidents include:

Prioritizing consistent driver safety training and enforcing clear driver policies

Strengthening your hiring process and regularly reviewing motor vehicle records

Using telematics tools to monitor behavior, track speed, and analyze claims data to help correct the root causes

Don’t forget to also review your insurance coverage to ensure you’re properly covered. Three areas to consider include:

Commercial auto coverage for vehicles owned by your business

Hired and non-owned auto coverage for seasonal or temporary drivers

Umbrella liability for added protection against high-dollar claims

2. Online sales growth brings new cybersecurity exposure

As online sales continue to expand across the horticulture market, cybercrime is also increasing.

Phishing scams, ransomware attacks, and fraudulent payment requests are now common risks for small and mid-sized horticultural businesses that may lack strong defenses. Even a single compromised email account or corrupted payment system can result in major financial and reputational losses.

Take steps to help protect your business:

Require multifactor authentication on all accounts

Back up critical files regularly and store them offline

Update firewalls and software promptly

Educate employees on spotting suspicious links and attachments

Cyber liability insurance can help cover costs tied to business interruption, data restoration, and required customer notifications.

3. Sustainability takes root across the industry

More businesses are embracing eco-friendly practices that reduce waste, conserve resources, and improve profitability—and that momentum continues to grow across the horticulture industry.

Customers increasingly expect the brands they buy from to reflect their values, and greener operations can set you apart. Sustainable efforts also help offset costs and can help you prepare for potential tightening regulations in areas such as water usage and packaging materials.

Here are three areas you can start:

Reduce plastic waste: Transition to biodegradable products (e.g., pots) and recyclable packaging when possible

Save water: Use drip irrigation, capture rainwater, and recycle runoff

Improve energy efficiency: Upgrade to LED lighting and heat-retention curtains

Sustainability efforts strengthen your reputation, attract eco-minded customers, and can even lower insurance risks by demonstrating proactive facility management.

Don’t forget to promote your initiatives on your website, social media, and signage—it’s a great way to connect with today’s environmentally conscious consumers.

4. Severe weather events are more frequent and unpredictable

From wind and hail to tornadoes and floods, extreme weather continues to affect more areas and for longer periods each year. There’s no longer a predictable “tornado season”—the threat is year-round and expanding geographically. For business owners, this means that structures once considered low-risk may now face higher exposure.

Here are a few ways you can prepare for severe weather events:

Inspect and reinforce frames, covers, and anchoring systems

Secure outdoor materials and equipment before storms

Create a response plan that encompasses employee safety, communication, and recovery steps

Insurance coverage to review:

Property insurance for structures, inventory/stock, and equipment

Business interruption coverage for lost income after a severe event

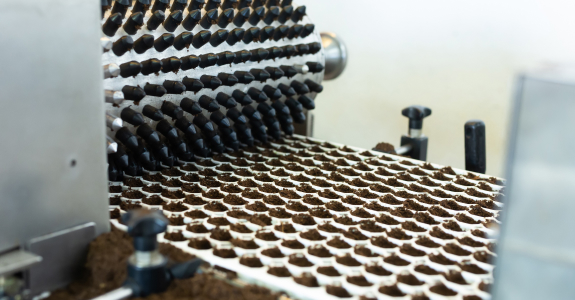

5. Horticulture businesses are carrying incomplete coverage for high-value and connected equipment

As technology advances, many horticultural businesses are realizing their insurance coverage hasn’t kept up with the true value of their operations. Equipment such as potting machines, conveyor systems, and environmental control sensors often costs far more than the general “equipment” line listed on a policy.

At Hortica®, we’ve seen situations where businesses had only $5,000 of coverage on systems worth $30,000 or more. If you’ve added automation, smart sensors, or other connected equipment, it’s critical to update your asset list and confirm that coverage limits reflect replacement values—not just purchase prices.

What you can do:

Keep an updated inventory of all business property, from structures and racks to equipment and climate control systems

Include serial numbers, purchase dates, and estimated replacement values

Review your coverage annually with your insurance representative

These steps help ensure you’re adequately protected and positioned for quick recovery if an incident occurs.

6. Adopting technology is helping manage labor and cost pressures

Labor shortages and rising input costs continue to impact this industry, making technology a vital solution. Innovations in automation, robotics, and precision agriculture are helping growers streamline operations, save on labor, and optimize yields.

From automated potting lines and robotic harvesters to vertical growing systems and smart irrigation, the future of horticulture is increasingly data-driven.

Benefits of horticulture technology investment include:

Improved consistency and product quality

Reduced waste through precise resource management

Ability to scale operations with fewer employees in a tight labor market

The upfront investment can be significant, and new equipment may require coverage updates. Your insurance provider can help ensure that your policy aligns with your technology investments and that you’re protected during installation and operation.

How horticultural businesses can adapt and thrive in 2026

The common thread across these trends is preparation. While you can’t control every challenge, you can control how ready your company is to respond.

By investing in employee training, reviewing your coverages, and embracing innovation, you’re positioning your business for long-term success.

As you head into 2026, schedule time to talk with your insurance representative. Review your policies, identify gaps, and make sure your coverage evolves with your business.

The more proactive you are today, the stronger your operation can be tomorrow.

How sustainability impacts insurance for greenhouse businesses

Workplace fire safety: 10 tips for horticultural businesses

Help protect your horticultural business with risk-relevant insurance coverage

The information in this article is for informational or entertainment purposes only. View our disclaimer by going to terms and conditions and clicking on Learning Center disclaimer in the table of contents.